Welcome to the 78th Coin Report. In today’s report, I will be assessing the fundamental and technical strengths and weaknesses of Morpheus Labs. This will be comprised of an analysis of a number of significant metrics, an evaluation of the project’s community and development and an overview of its price-history. The report will conclude with a grading out of 10. I hope you enjoy the read!

Introduction

This is the eleventh of my subscriber-exclusive Coin Reports, with Morpheus Labs winning the April poll. Each month, I will run a poll and publish a Coin Report on the winner either that month or the following month, available only to those of you that are subscribed to my premium content.

Keep your eyes out for the May poll, which will be hitting your inboxes soon.

I hope this report will prove objective where it must be and fair on more subjective matters. For those who’d like to learn a little more about Morpheus Labs prior to reading this report, here are some primary links:

Fundamental Analysis

General:

Name: Morpheus Labs

Ticker: MITX

Algorithm: ERC-20 & BEP-2

Sector: Blockchain-as-a-Service

Exchanges: Uniswap, Kucoin, Bilaxy, AscendEX, Binance DEX, Hotbit, HitBTC, Mooniswap, 1inch and Bitcratic

Launch Overview

Morpheus Labs was launched with a token sale in February 2018 that raised $9.6mn in exchange for its utility token, Morpheus Infrastructure Token (MITX). Originally, 1bn MITX were created, but 200mn were burned shortly thereafter. Of the remaining 800mn MITX, Morpheus Labs allocated 200mn to their token sale, in order to raise funds for development, whilst retaining 10% for the team, 10% for the reserve, 10% for the foundation; 15% for the ecosystem and partnerships and 30% for future exchange listings. MITX was issued on the ERC-20 token standard. Following launch, a token burn program was launched, with 76mn MITX having been burned thus far of the issued 800mn, with a target of 700mn MITX maximum supply by October 2022.

Morpheus Labs officially launched their platform on January 25th, 2019.

Price-History Overview

As Morpheus Labs has now been traded for around three years, there is plenty of price-history available. Whilst I will cover this at length in a later section, for now it will suffice to say that MITX formed its all-time low against Bitcoin at 30 satoshis in January 2020, having formed its all-time high shortly after initial trading began at 972 satoshis in May 2018. Against the Dollar, its all-time low came at $0.002 in March 2020, whilst it recently made an all-time high at $0.196 in March 2021.

Project Overview

The aims of Morpheus Labs are wide-ranging, to say the least, and there is undoubtedly a great deal of ambition here. In short, they are seeking to streamline the process for organisations to utilise blockchain-based solutions in a cost-effective and efficient manner, thus allowing for faster, more fluid innovation within and between businesses.

As stated in their whitepaper:

“Our objective is to build an enterprise-grade blockchain platform as a service (BPaaS) with an additional blockchain app marketplace that enables organisations of any size, regardless of whether they are a two-person company or a Fortune 500 company, to rapidly design, deploy and operate distributed ledgers.

Too much focus has been given to the price of cryptocurrency tokens but not enough to the fundamentals of Satoshi Nakamoto’s original purpose of the blockchain, which is to enable anyone and everyone to partake in the exchange of value and realise the power of the blockchain. We believe that blockchain technology has the power to change lives for the better and we are building a platform for inclusion. This BPaaS will be the vehicle to enable anyone to benefit from this technology.

Morpheus Labs’ BPaaS will help idea originators create their own blockchain innovation lab, by providing the necessary infrastructure and set of integrated tools. It will empower them to test-drive blockchain applications and experiment with the technology at a fraction of the cost and time.“

I look forward to evaluating the progress made towards these aims since inception.

Let’s begin with some Metric Analysis:

Metric Analysis:

Below are listed a number of important metrics, all of which are accurate as of 28th April 2021. For anyone reading this who has yet to read a Coin Report, it might be worth reading this section of the first report, where any potentially unfamiliar terms are explained. For any terms or metrics specific to this post, I will provide explanations besides the figures.

Metrics:

General:

Price: $0.105 (193 satoshis)

Circulating Supply: 423,062,426 MITX (source)

Total Supply: 723,999,995 MITX

Maximum Supply: 723,999,995 MITX

% of Max. Supply Minted: 100%

Network Value: $44,279,363 (816.51 BTC)

Network Value at Max. Supply: $75,776,663

Exchange Volume: $2,698,864 ($988,410 excluding wash)

Exchange Volume-to-Network Value: 2.23% (excluding wash)

Category: Lowcap

Average Price (30-Day): $0.142

Average Exchange Volume (30-Day): $2,080,076 excluding wash

Average Network Value (30-Day): $60,179,240

Average Exchange Volume (30-Day)-to-Network Value: 3.46%

Volatility* (30-Day): -0.1095

Average Daily On-Chain Transactions (30-Day): N/A

Average Daily Transactional Value** (30-Day): N/A

NVT*** (30-Day): N/A

% Price Change USD (30-Day): -33.8%

% Price Change USD (1-Year): +1812.2%

USD All-Time High: $0.198

% From USD All-Time High: -47.6%

Premine % of Max. Supply: 0%

Premine Location: N/A

Liquidity (calculated as the sum of BTC in the buy-side with 10% of current price across all exchanges): 11.51 BTC

Liquidity-to-Network Value %: 1.41%

Supply Available on Exchanges: 7,010,855 MITX

% of Circulating Supply Available on Exchanges: 1.66%

*Volatility is calculated by taking the average price over the given time-period, calculating the difference between it and the highest price and it and the lowest price over that same time-period, and multiplying those figures together. The closer to 0, the less volatility during that period, and vice-versa. Read this for more on volatility.

Supply Emission & Inflation:

Block Reward Schedule: N/A (maximum supply fully issued, with deflationary mechanisms in place)

Average Block Time: N/A

Current Block Height: N/A

Annual Supply Emission: 0

Annual Inflation Rate: 0%

Circulating Supply in 365 Days: N/A

ICO:

The following details were taken from this source and this source.

ICO Period: 23rd February – 16th April 2018

Total Tokens: 800,000,000 MITX

Total Tokens Available for Sale: 200,000,000 MITX

Total Raised: ~$9,600,000

Average ICO Price Per Token: ~$0.05

Total Tokens Sold: ~190,000,000 MITX

Further Details: Originally 1bn MITX were to be issued, but 200mn were burned.

Token Allocation:

- Team: 80,000,000 MITX

- Foundation: 80,000,000 MITX

- Ecosystem: 120,000,000 MITX

- Reserve: 80,000,000 MITX

- Listing: 240,000,000 MITX

- Token Sale: 200,000,000 MITX

Distribution:

Address Count: 111,770

Circulating Supply Held By Top 10 Addresses: 9.78%*

Circulating Supply Held By Top 20 Addresses: 13.79%*

Circulating Supply Held By Top 100 Addresses: 26.31%*

Inactive Address Count in Top 20 (30 Days of No Activity): 15*

*Excluding team and exchange-owned addresses but including subsequent private addresses in the list.

Analysis:

There’s rather a lot to work through here, but I’d like to begin as this section often does; with the General metrics, before moving through (the lack of) Supply Emission and Inflation and concluding with Distribution.

Firstly, let’s take a look at Morpheus Labs’ Volatility, which came in particularly high. I calculated its 30-day figure to be -0.1095, which places it 18th-highest amongst coins previously reported on (in the top fifth), indicating to me that it is likely not currently in accumulation, at least not against the Dollar, to which the volatility measure is tied.

Moving on, let’s take a look at the two Liquidity-related metrics:

For buy-side Liquidity, I calculated that there was 11.51 BTC of buy support within 10% of current prices across listed exchanges, equating to 1.41 % of its Network Value. This is impressive given the limited range of exchanges on which it is listed. Relative to prior reports, this places it 3rd-highest, certainly indicating that there is demand at current prices.

Looking at the sell-side, I calculated there to be 7,010,855 MITX available for purchase on the orderbooks, equating to 1.66% of the circulating supply. This is the 17th-lowest among prior reports, indicating that coupled with relatively high demand, there appears to be little incentive for holders to sell at present, with such little supply held within orderbooks.

Before I move on from the General metrics, let’s take a look at those related to volume:

Morpheus Labs traded a reported $2,698,864 of Exchange Volume over the past 24 hours, equating to 6.1% of its Network Value; an impressive figure. Unfortunately, it is highly likely to be a false one, although through no fault of the project itself. It appears that ~$1.7mn of this volume is coming from exchanges notorious for wash trading. Having examined the orderbooks myself, this does indeed appear to be the case. As such, if we discount these entirely, Morpheus Labs traded $988,140 in the past 24 hours, equating to a more modest but respectable 2.23% of its Network Value. Further, its Average Daily Volume for the past 30 days was $2,080,076, equating to 3.46% of its Average Network Value for the same period, having accounted for wash, which places it right in the middle of the pack.

Now, with regards to MITX’s supply emission, in short, there is none, as tends to be the case with ERC-20 tokens that were issued following an ICO. Thus, annual inflation is a wonderful 0%; great for the speculator. This, in essence, means that there should be no real headwinds for price growth. Moreover, Morpheus Labs are expected to burn another 23mn MITX by October 2022, reducing the maximum supply to ~700mn MITX.

Let’s wrap up this section with a look at Distribution:

Looking at the Morpheus Labs rich-list, I found that there were 111,770 holders, which is the 3rd-highest figure recorded in these reports and very impressive for a fairly small project. Of these, the top 10 addresses control 63.46% of the current circulating supply of 423mn MITX; the top 20 control 69.37%; and the top 100 control 80.08%.

Naturally, this is excluding team and exchange-owned addresses and consists only of private addresses. Regarding activity of the top 20 addresses, 15 are inactive over the past 30 days, with 4 accumulating and 1 distributing. There were net inflows of 4,760,644 MITX to these addresses during that period.

And that concludes this section; onto the Morpheus Labs Community:

Community:

There are two primary aspects of community analysis: social media presence and Bitcointalk threads. I’ll begin with the former before moving on to the latter.

Social Media:

Concerning social media presence, there are four main platforms to examine: Twitter, Facebook, Telegram and Discord.

Morpheus Labs is present on all platforms except Discord. To begin, let’s look at the various social metrics that I calculated from the Morpheus Labs Twitter and Facebook accounts:

Twitter Followers: 18,337

Tweets: 1,365

Average Twitter Engagement: 0.86%

Facebook Likes: 1,678

Facebook Posts (30-Day): 11

Average Facebook Engagement: 0.23%

As usual, I will be using RivalIQ‘s social benchmark report for evaluation purposes.

Twitter:

Morpheus Labs has a moderately large Twitter audience of 18,337 followers (+5,600 on its audience in February 2020), which places it 12th-highest among coins previously reported on. Its engagement is fairly strong at 0.86%, placing it in the middle of the pack. This is also 19x greater than average across all industries of 0.045% and 31.8x greater than the average in the Tech and Software industry of 0.027%. What I did like is that the team are clearly committed to regularly posting content, with updates posted every couple of days in general.

Facebook:

Morpheus Labs has a small Facebook audience of 1,678, which is only 33 Likes larger than it was over a year ago, which is quite poor and suggestive of neglect relative to Twitter. The engagement rate is much weaker at 0.23% despite the significantly smaller audience, but I am glad to see that the team is committed to keeping this audience up-to-date with developments with 11 posts in the past 30 days. Regarding engagement, its rate is 3x that of the median across all industries of 0.08% and 11.5x that of the Tech & Software Industry of 0.02%.

Discord:

There is no Discord group for Morpheus Labs.

Telegram:

There are 5,221 members of the Morpheus Labs Telegram group. Below, I have provided key takeaways from the past week of activity within the group:

- The group is generally quite active, with at least some discussion occurring on a daily basis, though by no means constant.

- Those that do communicate within the group seem committed to the project, with discussions focusing on the promotion of Morpheus Labs across social platforms and how those in the community can do their bit.

- The group is kept up to date with developments and events, with daily messages posted with links to new articles, resources and ongoing events.

- The team recently launched an NFT Launch Pad with accompanying source code on the Morpheus Labs SEED platform.

- A technical roadmap for 2021 can be found here also, but I have detailed this in a later section.

- The team recently partnered with Huawei Cloud and NewsCrypto.

- Overall, there is a degree of excitement around the future of Morpheus Labs from within the community but there are some concerns that the marketing isn’t yet running at full pace.

BitcoinTalk:

There is no active Bitcointalk thread for Morpheus Labs.

And that concludes my evaluation of the Morpheus Labs community.

Let’s now look more closely at development:

Development:

For the following Development analysis, I will be evaluating project leadership, the whitepaper, the roadmap, available wallets and finally providing a general overview of developmental progress:

Project Leadership:

The Morpheus Labs team comprises 15 employees as per LinkedIn, with 9 listed on the website.

More specifically, the core team consists of:

- Chuang Pei-han, CEO

- Dorel D. Burcea, CIO

- Bruce Lu Yang, CTO

- Sang Duong Van, Senior Blockchain Developer

- Trinh Tien Trung, Senior Blockchain Developer

- Bao Quoc Le, Senior Designer

- Tristan Nguyen, Blockchain Developer

- Minh Nguyen, Developer

- Thang Nguyen, Senior Developer

- Stella Lee, Sales and Marketing

Whitepaper:

As the whitepaper remains unchanged since 2019, I have copied in my notes taken when researching the project initially last year. I will dissect the progress made since then in a later section.

The whitepaper is 36 pages in length and begins with an executive summary, detailing the core aims of Morpheus Labs and the problems it is seeking to solve; namely, to provide a Blockchain Platform-as-a-Service that allows organisations to efficiently test out and develop blockchain solutions using different protocols within one cohesive environment, streamlining innovation and thus capturing greater value from their businesses. The client can be a small business or a Fortune 500 company and the platform will accommodate their individual requirements, allowing for intra-and-inter-business communications.

The document goes on to discuss the primary issues facing businesses that are seeking blockchain solutions, such as the plethora of choice in protocols; which is most suitable? Businesses also find difficulties with fitting use cases and evaluating benefits, as well as the extortionate cost of development for potential failures; by utilising Morpheus Labs’ BPaaS, these costs will be significantly reduced, allowing businesses to afford to innovate.

There are Four Pillars of Value provided here for their clients:

- Blockchain protocol choice; businesses can trial and test different technologies within one environment.

- Crowdsourcing; businesses will be able to solicit contributions from external sources.

- Enterprise-grade; the platform will be scalable for all organisations and fully secure.

- App Library; businesses will have access to ready to deploy apps.

Moving on, we find a page detailing the features supported by the platform, including the following:

- Multiple blockchains in one environment

- Team functionality for collaboration

- In-region hosted cloud data centres for reliable and scalable cloud environments

- User and identity access management to secure access to the platform

- Integrated cloud development environment with a full suite of tools

- Ready to deploy application library

- One-stop management for: provisioning and governing a network; provisioning software and middleware; mobile versions for project monitoring on the go; and applying operational intelligence to the network

We are then provided with a detailed look at the platform itself, which consists of an admin console, the dashboard, an operations console and the developer workspace. Screenshots are provided here of the working platform, with a clean, user-friendly interface apparent. We are also shown the Application Library, which is similarly designed for ease-of-use.

Moving on, there is a section dedicated to the market size, where we discover that the blockchain market is expect to hit $3.1trn by 2030, with Morpheus Labs expecting to capture 30% of the $690mn Serviceable Obtainable Market by 2021. This is hugely ambitious.

Now, turning to the Business Model, we find that there are a number of revenue streams available to Morpheus Labs, the primary three of which are the platform subscription fee, the app library fee and a course for development.

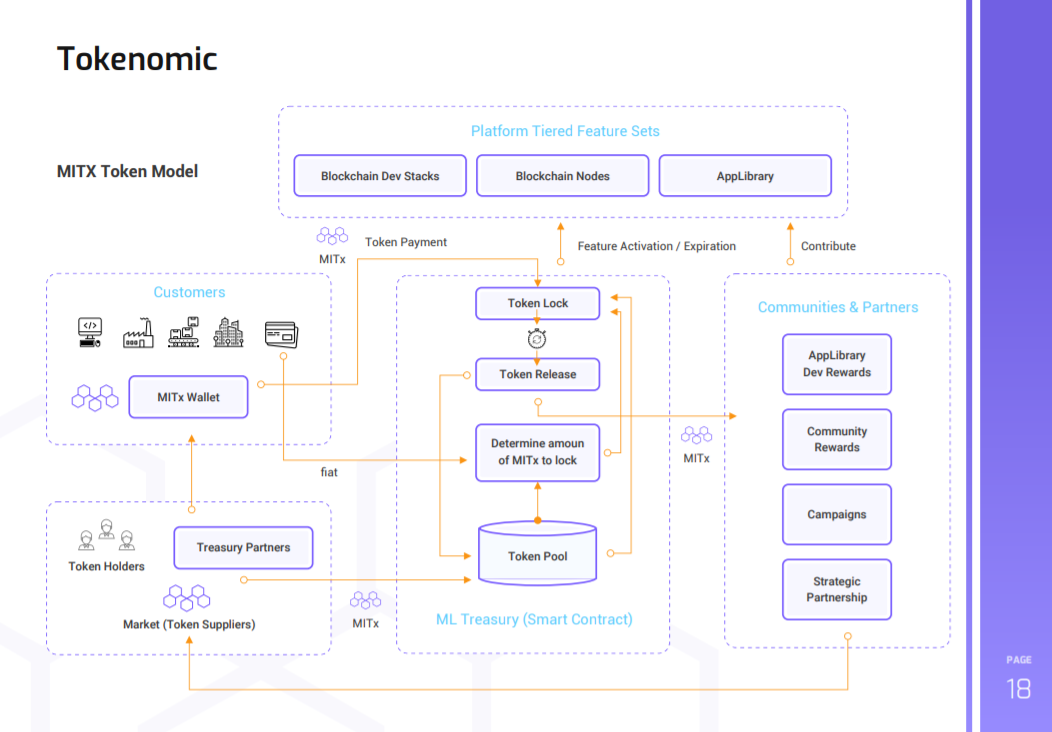

There is also a great tokenomics graphic for Morpheus Infrastructure Token (MITX), which I have provided below:

We are given a great deal of detail in subsequent sections about the tokenomics of MITX, beginning with Treasury Partners.

Here, we find that the entire platform will be exclusively powered by MITX, and that instead of forcing clients to purchase the token to use the platform (this would deter usage), instead Morpheus Labs will buy MITX directly from circulating supply using fiat payments for its platform. Treasury Partners will be essential to this process (they can be “liquidity providers, brokerage firms, OTC desks or substantial investors in MITX”, we are told) as these will buy from the market to provide tokens for customers. TPs will be selected by Morpheus Labs based on holdings and trading volume, primarily.

Regarding the platform subscription, clients can choose to pay in fiat or MITX tokens if they already hold them, with the latter expected to be the minority. Those that purchase in fiat will have the fee pegged to the MITX exchange rate, after which Morpheus Labs will purchase the equivalent from a Treasury Partner.

For the Application Library, this will be an open marketplace, with Morpheus Labs charging a commission on fees for app purchases or component and in-app purchases, as well as on recurring subscriptions. MITX will be used as a discount token within the marketplace, with publishers receiving a discount on commission for holding MITX. There will also be a revenue share scheme for holders of specified amounts of MITX.

Moving onto Blockchain Protocol Partners, here we discover that the protocols that Morpheus Labs partner with will provide the infrastructure that allows them to accommodate businesses. Protocols will pay a listing fee, payable only in MITX.

There will also be Community Nodes, whereby a specified amount of MITX will be staked whilst hosts are tasked with community growth, making the hosts eligible for rewards based on performance in this respect.

Finally, there will be a Product Council, which will consist of community members who assist with the development of Morpheus Labs, testing new features and providing feedback, all the while being required to hold tokens to ensure membership.

Moving on, we find a detailed overview of Proof of Alliance, which is the mechanism used by Morpheus Labs to “effectively regulate the token velocity across the platform and all involved stakeholders.”

There are three primary pillars of PoA, which are all staking mechanisms:

- Staking Mechanism for Developers: this involves Dapp developers staking MITX to increase app visibility within the Application Library, allowing developers to have apps featured at the top of search results, ensured via a tiered staking model, with $100/month of MITX being the minimum staked.

- Staking Mechanism for Subscription-Based Discounts: users of the platform itself will be entitled to discounts on their subscription fees, again utilising a tiered approach, with a minimum 10% of total subscription cost being staked for a 15% discount and a maximum of 20% for a 25% discount.

- Staking Mechanism Distributors: these will be required to lock up an amount of MITX that corresponds to the size and length of agreement, with three tiers available. Distributors are required to contact Morpheus Labs for detail on amounts.

Further in the whitepaper, we find a roadmap, though I have already covered this in an earlier section. We also find use cases for MITX, including the subscription payment for the platform and discounts within the platform, licensing fee costs for exclusivity for distributors specific to regions (these are companies that will be sole providers of the license to the platform, resold to their customers) and staking for exclusive features. We are also provided with details on the distribution of the token, which I have covered previously. Finally, we find testimonials from current clients.

Roadmap:

The roadmap is presented as a detailed blog post outlining the core goals that Morpheus Labs have for 2021, with three primary goals highlighted:

- Continuing the User Growth initiative for SEED 2.0 that began in September 2020

- Strengthening core products

- Securing mutually beneficial partnerships for the ecosystem

Beyond this, the blog posts details the mass marketing campaign that will be launched by the team, which will include the advertising of products and services in major crypto media outlets and relevant traditional media and on most visited crypto sites such as CoinMarketCap and Etherscan. There will also be regular AMAs and organic reviews from YouTube influencers, and the team will be investing in Google Adwords and SEO campaigns, as well as community campaigns to further spread the word.

Regarding Morpheus Labs’ SEED development, the CTO and CIO of the company will continue to work on strengthening the SEED (Solution Environment for Enterprise Development) platform, which simplifies the process of blockchain app development.

Lastly, the team have launched the Morpheus Labs Ambassador program to reward those that are actively involved in the community and focused on promoting the project globally.

Regarding a technical roadmap, I was able to find one in the Telegram channel for 2021, with Q1 focused on SEED Migration to Huawei Cloud and the launch of the NFT Launchpad on the SEED platform, followed by release of subscription staking, locked staking and community nodes in Q2, alongside the creation of a gas-less swap tool and the release of an External AppLibrary and API Library. Moving towards Q3, the team will be focused on Polkadot integration and co-creation of a dApp that applies both NFT and DeFi. Finally, in Q4, the team will be co-creating 3 dApps based on Polkadot / Substract that use MITX as a utility or governance token, as well as being focused on the implementation of the Integration Studio in SEED.

Wallets:

Morpheus Labs’ token – MITX – can be stored on hardware wallets like those of Ledger and Trezor as an ERC-20 token, as well as on mobile wallets, web wallets and local clients.

Developmental Progress:

Below, I have provided key takeaways from development updates published by the team over the past year, in order to better determine the progress that has been made since early in 2020. The sources for all of these events and facts are also provided below.

- Regarding partnerships, Morpheus Labs partnered with Natsoft, Conflux, Redblock, Sota Tek, Unstoppable Domains, Nervos, NULS, Shufti Pro and ICON in 2020.

- Morpheus Labs was invited to appear on Fintech Global, a live broadcast produced by the Institute of Fintech Research, Tsinghua University.

- The team were featured in the IMDA Blockchain landscape which promotes awareness and adoption of blockchain within Singapore.

- Morpheus Labs finished in the top 15 startups in the Huawei Spark Accelerator.

- PricewaterhouseCoopers Singapore engaged Morpheus Labs to develop Smart Compliance.

- The team placed in the top 25 globally in the Startup-O investment assessment program and in the top 100 in Slingshot.

- Morpheus Labs deployed a web application for NFT issuance called Bluesky.

- Morpheus Labs SEED was launched in July 2020, with over 2,000 active users.

- The team partnered with Huawei Cloud to drive blockchain adoption, launching an NFT collection in collaboration.

- Morpheus Labs partnered with 0Chain to facilitate blockchain adoption in enterprises, with 0Chain offering an enterprise-grade decentralised storage network.

And that concludes my fundamental evaluation of Morpheus Labs.

Technical Analysis

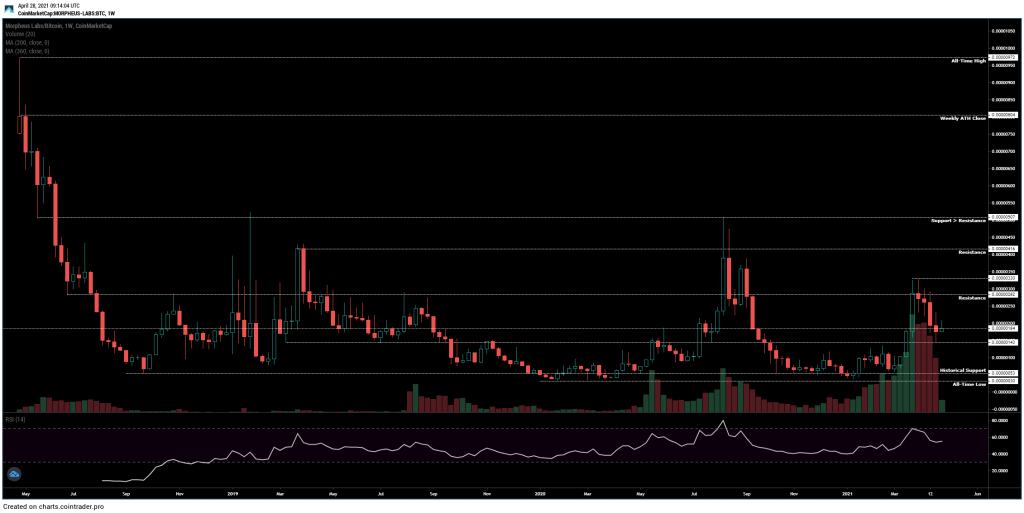

MITX/BTC

MITX/USD

If we begin by looking at MITX/BTC, we can see here that price made its all-time high shortly after initial trading began in May 2018 at 972 satoshis, before beginning a multi-month bear cycle, during which it fell to 53 satoshis in mid-September 2018. That became range support and led to a bounce back into prior support turned resistance at 282 satoshis, but price failed to reclaim the level and remained range-bound between the then-all-time-low and 282 satoshis for several weeks. In March 2019, price did manage to break out of the range but this proved to be a false breakout, with the pair losing 282 satoshis once again in April and continuing to retest it as resistance over the subsequent weeks. Then, in January 2020, the all-time low gave way – albeit briefly – with MITX printing a new low at 40 satoshis, from which it began a bull cycle throughout 2020, rallying all the way back into range resistance at 282, breaking and closing above it and spiking into resistance from May 2018 at 500 satoshis. This marked the top for that particular cycle, with MITX then fully retracing the rally throughout Q4 2020 into 2021, where 53 satoshis once again held as historical support. Since, we have seen the pair begin running again, but as it has historically done so, it failed at 282 satoshis in March 2021. At present, the pair has sold off back into an area of reclaimed support at 140 satoshis, above which it is holding. This looks like a perfect area to enter a new position, as invalidation is clear; a weekly close back below 143 would suggest that MITX needs to retest its range low at 53, so that would provide the exit point. If 143 holds, one could reasonably expect a retest of 282 to follow, with a breakout above that area opening up the 500-satoshi retest.

Turning to MITX/USD, the chart is quite different here, with the two year period between July 2018 and July 2020 in hindsight appearing to be a huge accumulation range between the all-time low at $0.002 and range resistance at $0.033. Despite the size of this range (both in duration and price depth), this is nothing new, as in hindsight much of the 2015-2017 price-action in altcoins turned out to be accumulation for the 2017/18 bull cycle, so we have seen this pattern before. Following a range resistance breakout in August 2020, with MITX hitting $0.06, the pair retraced back inside the range, re-accumulated, and has since begun its largest bull cycle, breaking to a new all-time high above $0.095 in early March 2021 and rallying all the way into $0.196, which remains the all-time high at present. It has since sold off all the way back into resistance turned support around $0.075, which held firm. Whilst it is possible the cycle is over for MITX/USD, with the BTC pair looking the way it does and with BTC/USD not yet looking like a macro top is in, it is more likely that we see some consolidation here for the pair followed by another leg higher towards that $0.24 area a little later this year. This would be invalidated if $0.07 is lost, in my opinion, with the pair likely to retrace back into $0.03 at that point.

And that concludes my evaluation of Morpheus Labs.

Conclusion

This report is now over 4,000 words, and it is time to draw it to a close.

My final grading for Morpheus Labs is 8 out of 10.

Here, you can find my grading framework, for reference.

Lastly, here is a link to a Google Sheets file with any significant data from previous reports compiled for cross-comparative purposes. I will keep this updated as I continue to write these reports.

I hope this report has proved insightful and that you’ve enjoyed the read! Please do feel free to leave any questions in the Comments, and I’ll answer them as best I can.