N.B: In the spirit of full transparency, the following product overview is a Sponsored Post.

For this one-off blog post, I will be providing an overview of Coin Market Manager (ref link, FYI), which, if you aren’t already aware, is a one-stop shop for portfolio tracking, trade statistics, journaling and more useful stuff for speculators.

They have also been blog sponsors in the past, as keen readers will remember, and I do believe they have something genuinely useful here.

Within this post, I will seek to provide a detailed overview of the key components of the platform, as well as its utility for traders.

Introduction

Before we begin with the actual overview of Coin Market Manager, it’s worth just providing a little background information:

The platform was founded by David Kanzen, Simeon Howard and Gary Lee, all of whom are part of the crypto community, particularly on Twitter. They built Coin Market Manager to assist in their own trading, with so few advanced portfolio trackers available in the space. The purpose was to build a one-stop user interface within which trade data and portfolios could be both managed and evaluated, facilitating the improvements to strategy and thus returns that all traders seek.

Pricing

At present, Coin Market Manager has a three-tier pricing system:

As you can see, they currently offer a basic account that is completely free, a pro account with a monthly subscription and a pro account with lifetime access.

- Basic: The Basic account is ideal for new users, as it provides a basic portfolio overview and the automated trading journal, in particular. We’ll get into what all of these features are, but for now it will suffice to say that this is a great stepping-stone for traders wanting to learn more about Coin Market Manager before paying for the professional platform.

- Pro: The Pro account is where the real magic happens and is priced at $19.99 per month, with the team currently offering 2 months free for new sign-ups. For your $20 a month, you get all the basic features of the platform, plus rolling P/L calculations, break evens on trades, far more advanced analytics, trade history and performance charts, leg breakdown data that separated each aspect of a trade into legs and provides statistics at each level, and 3500 trade uploads. As we’ll come to shortly, this is where you can really dive into your completed trades and assess mistakes, strengths, patterns of behaviour and more.

- Pro (Lifetime): As you might expect, the lifetime Pro account is the most advanced, providing everything in the previous levels, along with lifetime access to the platform, unlimited trade uploads, 20,000 conversion credits to assist in converting P/L into BTC values for non-BTC based trades and 25 additional account slots. The price for a lifetime account is $999. Naturally, this is not for beginners or those who’d like to test out the platform, and is instead geared towards full-time traders that are adept at using the tools Coin Market Manager provides. One thing I’d like to note here is that perhaps the cost is a little steep relative to the monthly price for Pro membership, as one could pay monthly for four years for the price of lifetime access.

Now that we’ve got pricing out of the way, let’s take a look at the platform itself. For those that are already interested in signing up for a free account just to test the waters (or perhaps to have more clarity whilst reading through this review), you can sign up here (non-referral) or here, if you’d like to sign up under my referral. If you do sign up with my referral, you get a 20% discount on your purchase, should you find the platform worth your time and worth an upgrade, just to let you know.

Platform

So, let’s say you’ve signed up for an account. What next? Well, upon logging into Coin Market Manager, you’ll see this:

This is the Coin Market Manager dashboard for new users, where you will be able to link your exchange accounts to begin to populate the platform with your trade history. As you can see, they currently have 7 exchanges that can be connected: Binance, Bittrex, Kucoin, Coinbase, BitMex, ByBit and Deribit.

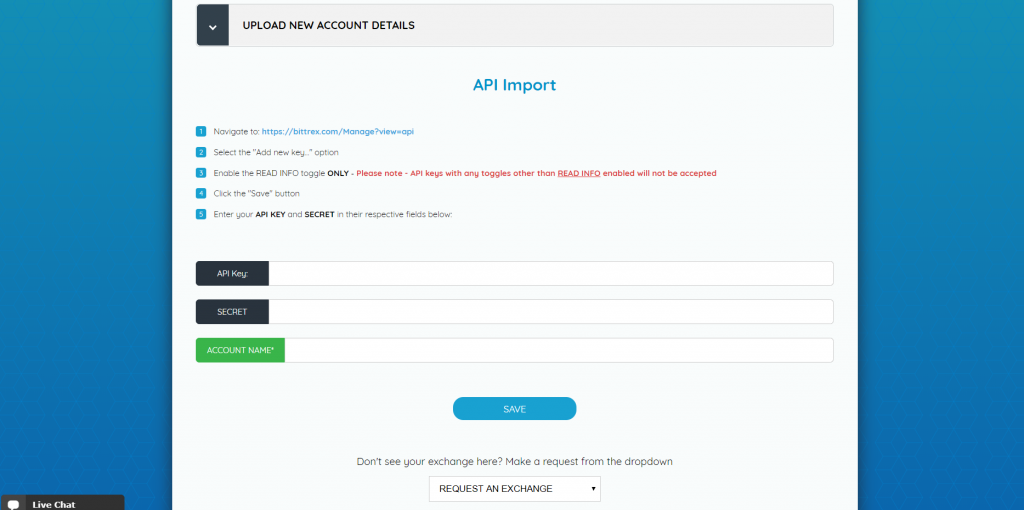

The way this works is via a simple read-only API key, which allows Coin Market Manager to auto-fill your data for you instantly. If you click one of the exchanges, you’ll see something like this:

All you need to do at this point is find the API key on the chosen exchange and follow the instructions provided, press Save and your trade data will begin to populate the dashboard.

Following this, your dashboard will look a little more like this:

Now, having populated the dashboard, you’ll notice the following underneath the linked exchange, which is where we start to get into the data. Obviously, as this is one of my live accounts, I have hidden some of the data, but we’ll run through what’s displayed here:

So, this is your specific exchange dashboard – and if you’ve linked more than one account you’ll have one for each. Here, you find basic info on your deposits and withdrawals, measured in BTC, as well as the market value of your portfolio and the proportional allocations of your altcoins. All of this is found below Market Value. As you can see, I have three altcoins that I have transferred into my account to illustrate this (don’t permanently store your coins on exchanges!).

Beneath this, we have another basic breakdown of your BTC balance, and below this we have a Live Investments section.

In this section, you’ll be able to have a quick glance at your total buys in BTC, your rolling P/L for open positions, and your total sells + market value in BTC. Beneath this, we are given an individual breakdown per asset, with live prices, breakevens, rolling P/L, market values and portfolio breakdowns. All of this is, of course, useful for general portfolio tracking. Below this, you can also find your Historic Investments, which, when shown, will bring up every completed trade on that account.

More importantly. if you click on an individual asset in the live or historic investments areas, you find leg breakdowns for the coin, where each order is individually situated, alongside an integrated TradingView chart and notes tab for jotting down any quick thoughts you might have.

Leveraged Trading Accounts:

Now, all of this is great for our spot altcoin trades on exchanges like Binance, Bittrex or Kucoin, but it is for BitMex, ByBit or Deribit users that this dashboard becomes invaluable.

Admittedly, I have not been a BitMex user for over a year now, so I do not benefit from the features provided here and thus cannot provide any screenshots, but I will run through everything that Coin Market Manager do provide for you degenerates in an attempt to reduce that degeneracy. I am also not a trader at ByBit or Deribit, but similar dashboards appear for both, and it is worth mentioning that both are officially partnered with Coin Market Manager.

Traders at those three exchanges will have more advanced dashboards, extremely helpful for scalpers and day-traders in particular who have many completed trades on a weekly basis. Core features include:

- Real-time balances and rolling PNL for accounts and individual trades in BTC and Fiat, along with deposit/withdrawal history.

- All positions displayed in a single interface, including aggregated positions and unrealised/realised PNL.

- Advanced trade view, with auto-pulled data that generates a comprehensive breakdown of trade history, with statistics such as trade duration, account percentage gains, commissions paid, an automated chart screenshot with entry and exit (BitMex only, I believe), maximum favourable excursion and more.

- A performance chart for the account that is highly customisable based on dates or number of trades.

- Analytics on the entire account, including win rates, average wins vs average losses, most profitable trading times and days, fee expenditure, funding expenditure, total longs vs shorts, individual data for longs and shorts etc.

- A balance history chart.

As you can probably imagine, there is a lot of valuable data here for regular traders (and I personally hope the team add support for FTX soon, so I too can make use of the more advanced statistics.)

Before we move on, notice the icons at the right of the dashboard: here, you find quick links to the Dashboard, Journal, Scanner (a BitMex analytics tools providing insightful data, as shown below), Account Settings, Conversion Hub, Math Lab (a series of calculators that will definitely come in handy, also depicted below) and a Welcome Tutorial for new users.

Scanner:

Math Lab:

Moving on from the dashboard, let’s take a look at the navigation menu, which will look like this:

You will also notice a megaphone icon next to the navigation menu, which brings up recent announcements from supported exchanges:

From the navigation menu, we can find the Journal, which is one of the more useful aspects of the platform and a place where the data seen on the dashboard can be utilised and evaluated.

Any trader with any degree of consistency will tell you that journaling is one of the most important aspects of trading. It is where we find our strengths and weaknesses, where we discover patterns of behaviour and where we learn about and refine our strategies.

I, like many, have been using spreadsheets for the vast majority of my journaling. Coin Market Manager makes the entire process far easier than manually inputting all of our trade data into Excel, as it uses an auto-import feature (available for Pro users) to pull all the account data and generate all the statistics you could possibly need. I should note that Basic account users also have access to the Journal, but they would need to manually input trade data as opposed to utilising the auto-import feature.

Once you’ve navigated to the Journal, you’ll be able to create your own and either begin manually importing trades or auto-importing if you’re a Pro member. I imported some prehistoric BitMex trades to provide an example, along with some open positions on Binance:

As you can see from above, the Journal allows for multiple journals to be created, if you have specific accounts you’d like kept segregated.

You’ll see an overview page once some trade data has been inputted, with Open Trades and Concluded Trades visible. This just gives you the basic overview of each trade, with info such as size, duration, entries and exits, stops, targets and account risk. For concluded trades, you’ll also get your total R once stop losses have been inputted, as well as win rates and results. As you can see, there is also a Chart and Tags column, which will display the number of each attached to the individual trade within the Journal.

To do so, click on one of your trades and it’ll load up an individual trade page, like this:

As you can see from above, this trade was taken in July 2019 on BitMex, with a long position opened on the XRP futures contract. You can see my average entry and target, which also became my exit for this position. I clearly did not input a stop loss at the time, hence the lack of values for the R columns. You are able to edit these figures individually, post-trade completion, and live trades will continue to auto-update. More importantly, here we can see the real utility of the journal, where you can import TradingView charts, start a thread with any thoughts you might have or apply tags to the trade (i.e. Swing Failure Pattern or Breakout/Retest). The tag feature is particularly useful, as it allows you to build up a picture over time of certain strategies and their individual strengths and weaknesses. You can filter you trade analytics by tag, for example, to find all of the aforementioned statistics on certain tagged trades.

Lastly, if you navigate back to the Journal Overview page, you can click through to Analysis, which open up a full trading report on all of your journaled trades, with a trade size report, trade duration report, tag reports, win rates, average R for longs, shorts and entire accounts, average account risk and more.

Undoubtedly, this is a powerful feature once you start populating the journal with trade data, as you can really begin to discern what is working for you and what you need to minimise or scrap entirely from your strategies.

Beyond this, they also have a roadmap accessible via the navigation menu, with a voting system on future releases for priority. This can be found here (ref link). There is also a Completed tab that outlines recent releases.

Finally, Coin Market Manager have provided an FAQ for new users that is well-worth the read, also accessible via the navigation menu.

And that concludes my overview of the Coin Market Manager portfolio tracking platform.

I personally look forward to seeing how the platform grows and develops and no doubt I will be using it more as more exchanges become supported. For now, it is ideal for monitoring and evaluating my spot trading and there is clearly even more to be found for BitMex, ByBit or Deribit traders.

If you’d like to sign up for a Basic account to try it out, here’s a non-referral link and here’s my ref link, if you’d like 20% off any purchase.

Thank you for reviewing this, Nik. I’ve been looking for a cloud-based journaling and portfolio tracking for a while, but not yet found a good platform. Will definitely give this a try.

No problem!